Growth through Good

Financial Advisors Can Increase AUM by Empowering Foundations & Endowments with Mission-Aligned Investing

Leveraging Impact with Mission-Aligned Investments

Foundations and endowments are increasingly looking to impact investing to further their missions and compound their impact. Impact investments are investments made with the intention to generate positive, measurable social or environmental impact alongside a financial return. Once considered a niche investing strategy, the Global Impact Investing Network (GIIN) now estimates the size of the global impact investing market to be $1.164 trillion.[1]

Traditionally, many foundations distributed at least 5% of their assets for charitable purposes as mandated by U.S. tax law[2] and invested the remaining assets, focusing primarily on the financial aspects of the investments rather than the impact. These investments were often not aligned with the organizations’ missions and sometimes even directly contradicted grantmaking goals. To illustrate, investing in fossil fuels may undermine the mission of an organization working to combat climate change. Other endowments faced similar challenges aligning investment assets with their purpose.

With growing evidence that it is possible to pursue sustainable, mission-aligned investments without sacrificing financial performance, an increasing number of foundations and endowments are rethinking their investment strategies. The Ford Foundation, for example, made a $1 billion commitment to impact investing in 2017, and smaller foundations like the Fink Family Foundation were also early pioneers of this approach. Many foundations and endowments, however, have yet to make this shift.

Opportunity for Financial Advisors

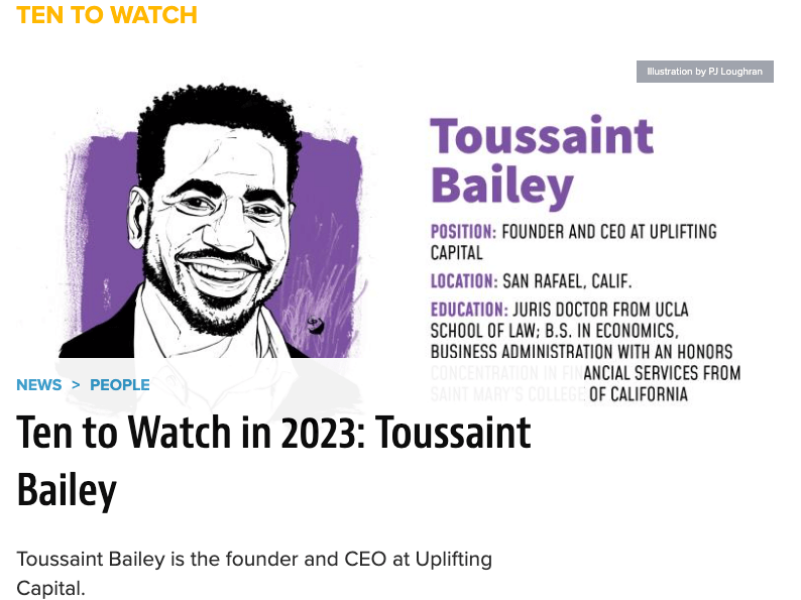

Impact investing presents an opportunity for financial advisors to attract and retain new clients, showcase their expertise, and provide value. As more foundations and endowments look to leverage the financial markets to effect positive change, knowledgeable financial advisors can help foundations and endowments align their investments with their goals and values. Although the Ford Foundation uses an in-house team to manage its investments, smaller foundations and other organizations with endowments rely on financial advisors to guide their investment strategies.

The potential client base is substantial. There are over 140,000 private foundations in the U.S. with a combined assets under management of $987 billion.[3] Of these foundations, 98% have assets of less than $50 million each, and 67% have less than $1 million.[4] Beyond private foundations, numerous churches, museums, and nonprofits also maintain endowments, and many of these institutions work with financial advisors to achieve their investment objectives.

In addition to attracting new clients, helping current foundation and endowment clients align their charitable missions with their investment goals provides an opportunity for advisors to deepen their relationships with clients. Financial advisors should aim to meet clients where they are when opening dialogue about mission-aligned investing. Some may be familiar with and interested in impact investing, while others may have little exposure to the space or hold common misconceptions.

Clients need not commit 100% of their endowments to their mission, and there are a wide range of impact investing approaches that can be utilized. Contrary to common misconceptions, many impact investments target market rate returns and can be used to build highly diversified portfolios to mitigate risk. While some institutions may be willing to accept lower returns and able to employ an investment strategy that is very targeted at its mission, impact need not concede financial returns (see below). Understanding both the clients’ goals and the landscape of impact investing options will enable advisors to better serve their clients.

Impact Alpha

It is a common myth that impact investments necessarily sacrifice financial returns, and foundations and endowments may incorrectly believe impact investing must be concessionary. The GIIN’s 2020 Annual Investor Survey found that 92% of impact investors seeking market-rate returns reported that their investments were performing in accordance with market expectations.[5] Incorporating an impact objective might actually improve financial performance.[6] Consumer demand, and in turn expenditures, for impactful products and services is increasing.[7] Moreover, new technologies have the power to tackle many of the world’s most pressing challenges and continue to experience significant growth.[8] Sustainable, impactful companies also attract talented employees. In fact, a growing number of tech workers are shifting their careers to work at companies fighting climate change.[9] These factors, among others, contribute to successful businesses that drive financial value for investors.